Cheaper premiums

The younger you are, the lower your premium.

You’ve just landed your first job. You’re figuring out rent, groceries, and maybe your first vacation.

Insurance? Sounds like a boring adult thing. But guess what? 20s are the best time to get insured.

Why?

The younger you are, the lower your premium.

Better deals – You’re likely to have no pre-existing illnesses.

Peace of mind later – You lock in rates for the future.

Real Talk: A ₹1 crore term insurance plan in your 20s can cost you less than a Netflix subscription per month.

Papa’s Advice: Insurance in your 20s isn’t just smart—it’s a superpower. Lock in low rates, and thank yourself at 40.

Two popular life insurance plans. One protects. One protects and invests. Which ones

right for you? When it comes to life insurance, not all plans are built the same.

Two of the most common options—Term Plans and ULIPs (Unit Linked Insurance Plans)—often leave people confused. One is a straight-up protector; the other is a multitasker. Let’s figure out which papa fits you best.

ULIP Papa, on the other hand, is a blend of life cover and investment. Part of your premium goes towards insurance, and the rest is invested in equity or debt funds. Over the long term, your policy grows with the market. Sounds great, right? But with higher returns come risks and charges. ULIPs are better suited for those comfortable riding the market rollercoaster and who want both wealth building and security.

Mix of insurance + investment means:

- Market-linked returns (with risk)

- Good for long-term wealth building if you’re okay with some risk

Verdict: Want only protection? Go term. Want growth + protection? Try ULIP.

Go for a term plan if you want simple, affordable protection. Pick ULIP if you're looking for insurance + investment in one—and you understand the risks involved.

Papa Tip: Never blindly mix protection with growth. Know your priorities, assess your goals, and choose like a smart papa would.

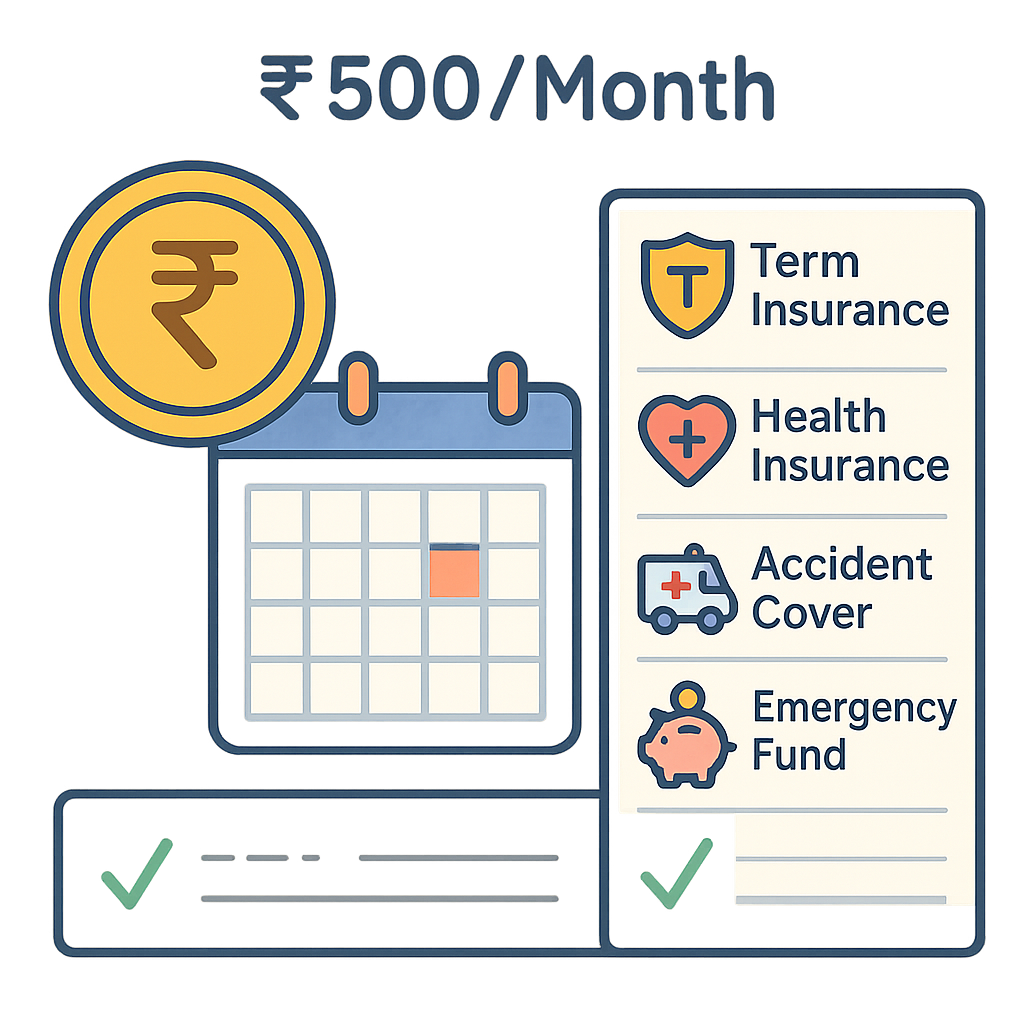

Budget & Money Planning – Can You Get Covered with ₹500/Month? Short Answer: YES.

Here's what ₹500/month can buy you:

- Term life cover of ₹50–75 lakhs (if you’re under 30)

- Basic health insurance plan (limited coverage)

- Accident rider or hospital cash benefit

Breakdown:

- Term Plan – ₹300/month

- Add-ons – ₹150/month

- Emergency fund – ₹50/month (Start saving!)

Papa’s Budgeting Tip: Insurance is protection, not an expense. Fit it into your budget the way you do for data plans or dining out.

Why It’s Important: Kids fall sick. A lot. Whether it’s a school flu or something serious, a good health insurance plan protects your savings and ensures the best care.

What to Look For:

- Family floater vs individual plan

- Coverage for newborns and vaccinations

- No room rent limit in hospital stays

- Daycare procedure coverage

Papa Tip: Always check if your policy covers NICU expenses for newborns—it’s often left out!

By: Arun M., 35, Mumbai

I bought a health insurance plan in 2019. In 2023, I had surgery for a knee condition. My insurer rejected the claim, saying it was a pre-existing condition. I was shocked.

My mistake? I didn’t declare a minor knee pain I had 3 years ago.

Lesson: Always declare even the smallest health issues. The premium might go up slightly—but at least your claim won’t be rejected.

Papa Says: Honesty at the time of buying = protection when you need it most.

Why This Matters:

Maternity-related hospital bills can cross ₹1.5–2 lakh easily in India. A standard health plan may not cover them unless specified.

What to Check:

- Does the plan have maternity coverage?

- What is the waiting period (usually 2–4 years)?

- Is the newborn covered automatically?

Bonus: Look for women-specific critical illness riders (like breast or cervical cancer).

Papa’s Advice for Mamas: If you’re planning a family, plan your policy 2–3 years in advance. The sooner you start, the better the benefits.

Don’t Panic. Prepare. Here’s your pre-hospital checklist:

Pro Tip: Take a photo of all documents and email them to yourself. Digital backups save lives (and claims!).

What’s New? IRDAI has said insurers must cover pre-existing illnesses after 3 years, no matter what.

What That Means: If you’ve declared your illness and completed 3 years, your claims can’t be denied on that basis.

Why It Matters: Earlier, some companies denied claims even after 3–5 years. This rule adds much- needed fairness and transparency.

IRDAI (India’s insurance regulator) has made a major change that could positively impact your health insurance claims. According to the new guidelines, insurers must cover pre-existing conditions after 3 years of continuous policy coverage, no exceptions allowed.

Earlier, some insurers had vague clauses or extended waiting periods that led to claim rejections, even after 4–5 years of holding a policy. Not anymore! This rule brings greater clarity and fairness for customers. If you've disclosed your medical condition at the time of buying the policy and completed 3 years of coverage, the insurer cannot deny a claim saying it’s due to a pre-existing illness.

This is especially helpful for those with diabetes, hypertension, thyroid issues, or even prior surgeries—conditions that are common but often treated unfairly. IRDAI’s directive applies across insurers, making claim experiences more transparent and predictable. No more grey areas. No more fine print surprises.

Just honest coverage.

Declare all conditions, wait out the period, and sleep easy. Declare your medical history truthfully, stay insured for 3 continuous years, and breathe easy.

The law now protects your right to claim fairly!