So, Papa, here’s the deal. Life insurance is like

the big umbrella term (pun intended) for different ways to protect your family financially. And term insurance? That’s one of the simplest, most budget-friendly ways under that umbrella. But the question is — which one is right for you? Let’s break it down with some real-life papa scenarios.

Term Insurance

- Cost: Low

- Coverage: High sum assured

- Returns: ❌ None

- Tenure: Fixed term (10–40 years)

- Best For: Pure protection needs

Life Insurance

- Cost: Higher

- Coverage: Moderate to high

- Returns: ✅ Yes, Investment returns

- Tenure: Lifetime coverage

- Best: Protection + Wealth building

The Budget-Smart Papa

Meet Papa Raj.

Two kids, home loan, school fees, and a monthly EMI that sometimes makes him gulp his chai extra hard.

For Raj, Term Insurance is a perfect fit—maximum coverage for minimum cost. He

doesn’t need investment returns; he just wants to make sure if something happens to him,

his family’s bills and dreams are still covered.

✅ Why it works: Raj can get ₹1 crore cover for a fraction of the cost of other policies. More peace of mind, less wallet pinch.

The Long-Term Builder Papa

Meet Papa Sameer.

Sameer likes the idea of insurance that also grows his money. He opts for Whole Life Insurance or ULIP (Unit Linked Insurance Plan)— policies that mix protection with savings/investment. Over the years, it builds a fund he can use later, while still keeping a life cover.

✅ Why it works: Sameer’s okay paying a higher premium because he sees it as part

insurance, part investment.

Meet Papa Arjun (Term Insurance Hero)

Two kids in middle school, a home loan, and a scooter loan. Arjun’s weekends are spent

juggling tuition drop-offs and cricket matches.

For Arjun, Term Insurance is the smart shield—maximum coverage for minimum cost. He’s

not looking for fancy investment returns right now, just a guarantee that if life throws a

bouncer, his family can still hit sixes.

✅ Why it works: Arjun can get a ₹1.5 crore cover for the price of a monthly family pizza

night. Safety without straining the monthly budget.

Meet Papa Sameer (Life Insurance Builder)

An IT professional with a steady income, Sameer has already cleared his home loan and is now thinking long-term—college funds, retirement, and maybe a small café by the beach someday.

For Sameer, Life Insurance with savings is perfect—it builds wealth slowly while keeping

his family protected.

✅ Why it works: Sameer’s plan will mature right around his retirement, giving him a second innings fund plus lifelong coverage.

Meet Papa Karan (Business Papa)

Runs a small logistics company, where cash flow isn’t always predictable. Karan worries

about both protecting his family and having a fallback fund for the business.

For him, Life Insurance doubles up—security for loved ones and a lump sum that can also

work as collateral if needed.

✅ Why it works: Karan’s premiums stay consistent, and the maturity amount can give his business an emergency cushion.

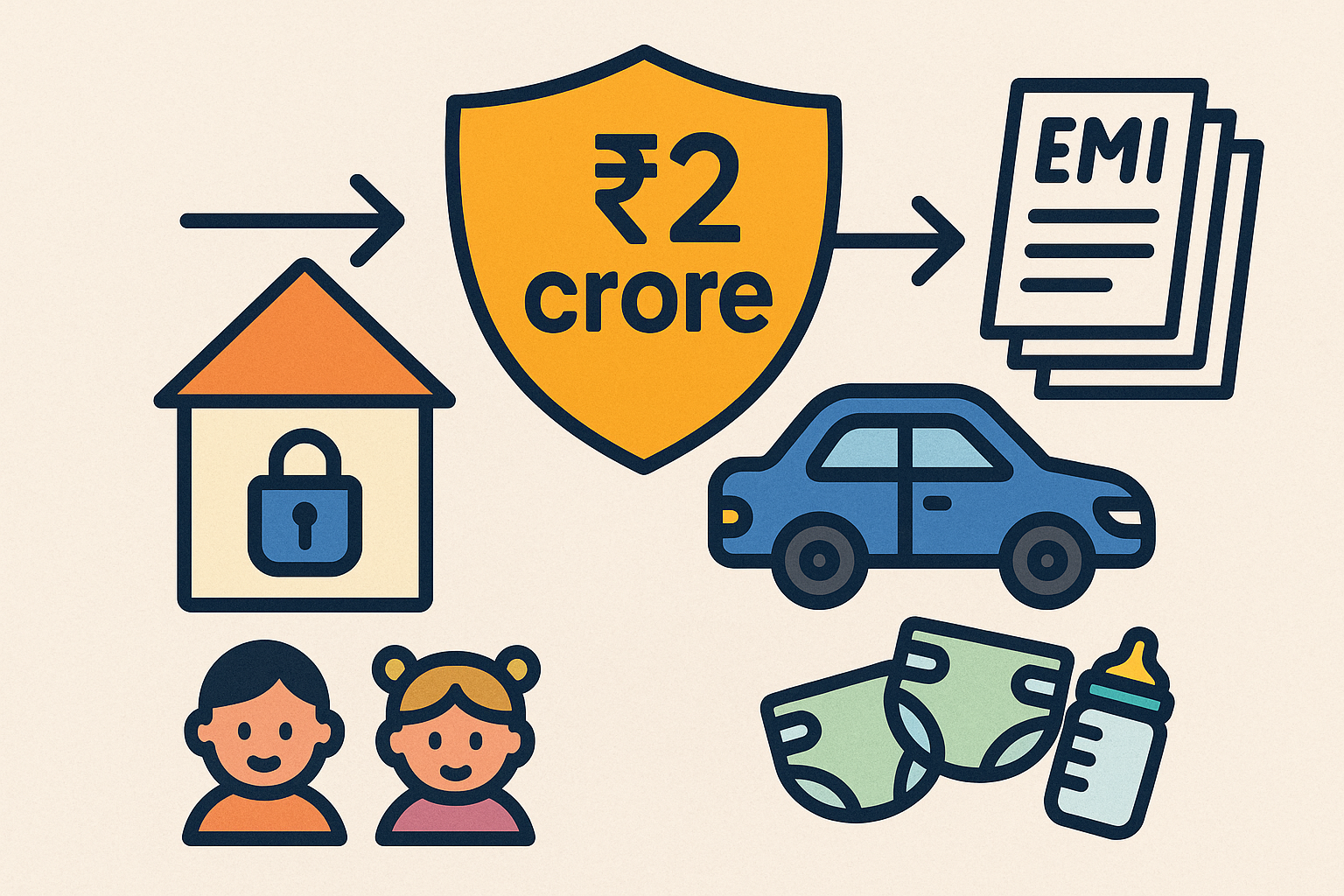

Meet Papa Naveen (Debt-Heavy Defender)

Still paying off a big home loan and car loan, with two tiny tots at home. Naveen is laser-

focused on ensuring his family isn’t burdened with EMIs if he’s not around.

Term Insurance is his best bet—huge coverage at a price that doesn’t compete with diaper

expenses.

✅ Why it works: ₹2 crore cover at a shockingly low premium means the house stays in the family’s name, no matter what.

Meet Papa Mohan (Legacy Planner)

A 52-year-old father whose children are already working. Mohan’s priority now? Leaving

behind a secure, tax-efficient legacy.

Life Insurance with a lump sum payout ticks the box—it’s more about gifting peace of mind

than protection from loans.

✅ Why it works: The plan’s maturity value will go to his kids, ensuring they remember him not just for his jokes, but also his foresight.